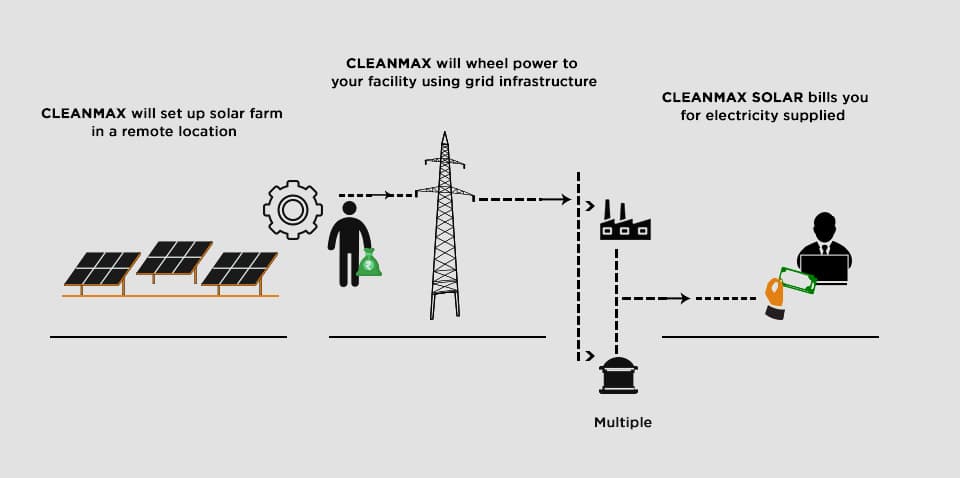

Whatever your reasons for considering alternative power sources, the end result is the same. You will save on electricity while meeting all your power needs. Captive or Group captive power is one such power generation option that helps you meet all your electricity needs while also enjoying tariffs lower than the prevailing grid tariff rates.

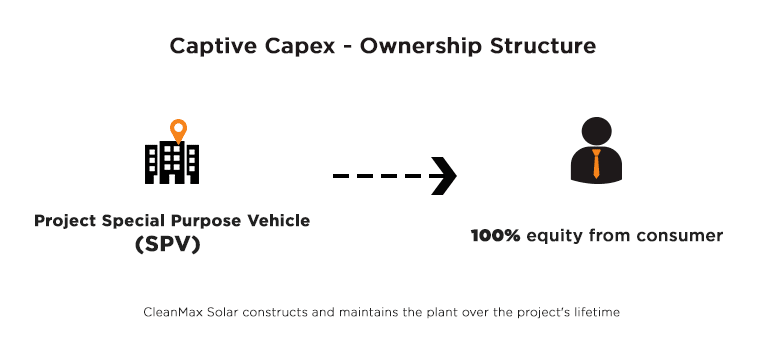

In the captive capex model, the corporate buyer for a utility scale renewable project makes the upfront capital investment. The buyer owns the power-generating asset, and the solar power generated is used for the corporate buyer’s self-consumption. CleanMax constructs the plant, and also operates and maintains it over its lifetime.

Open Access charges from the grid are applicable, but unpredictable charges, such as cross-subsidy surcharge and additional surcharge, are waived in captive and group captive projects.

Under this structure, a corporate buyer who holds the asset on its balance sheet is also eligible to claim tax benefits through accelerated depreciation.

CleanMax will provide complete turnkey EPC solution while commissioning the plant with necessary regulatory approvals and due-diligence. In addition, CleanMax will also operate and maintain the plant over its lifetime of 25 years.

A variant of the captive model is the group captive model. Under the group captive model, a project is developed for the collective usage of one or many corporate buyers. CleanMax sets up a Special Purpose Vehicle (SPV) for group captive wherein the corporate buyer(s) hold only 26 percent of equity in a project and need to collectively consume at least 51% of the power with the PPA. Here too, CleanMax will take complete responsibility for building, operating and maintaining the project.

The corporate buyer can avail open access benefits of a group captive project without being required to completely own the project. Here, CleanMax will bear 74% of the investment – with the corporate buyer holding at least 26% equity. This is done to meet the ownership criteria that will allow exemption of cross-subsidy surcharge.

Even though the user is required to purchase electricity from CleanMax through a Power Purchase Agreement (PPA), it comes at much lower rates than prevailing grid tariffs, resulting in guaranteed savings on every unit consumed.

CleanMax will provide complete turnkey EPC solution while commissioning the plant with necessary regulatory approvals and due-diligence. In addition, CleanMax will also operate and maintain the plant over its lifetime of 25 years.

The corporate buyer should ensure that a Group Captive project is fully compliant with the spirit of the law and with the Electricity Act and the proposed amendments to the Electricity Rules by following two simple guidelines: